Whole Life Protection

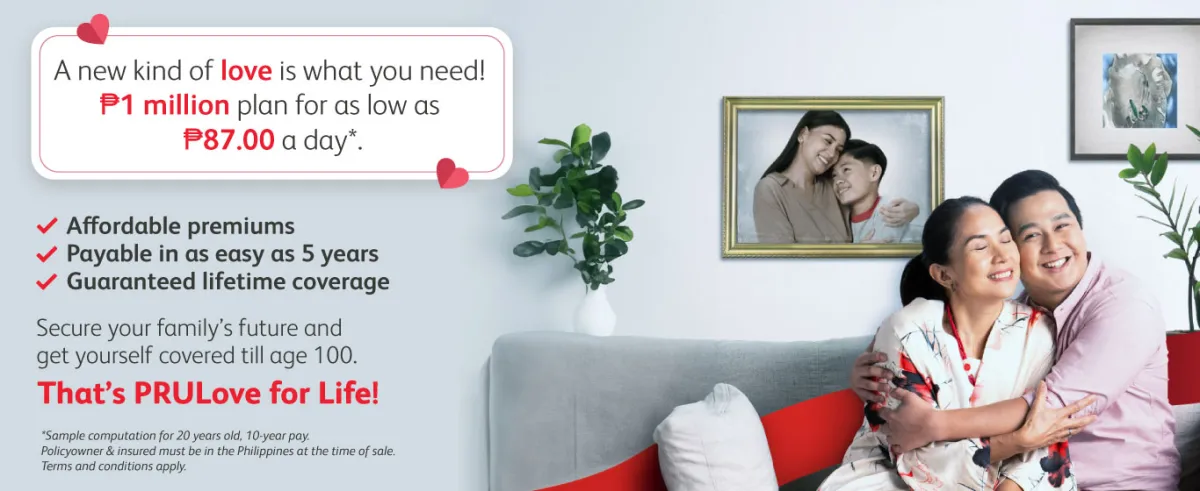

PRULove for Life

Affordable premiums, payable in as easy as 5 years. Whole life insurance with guaranteed coverage till age 100 – That’s

PRULove for Life!

Learn more about the product

Core Benefits

Death Benefit – We provide a lump sum death benefit equal to the Sum Assured plus any accumulated dividends less any outstanding policy loan if the death of the Life Insured occurs before the Policy Maturity Date.

Maturity Benefit – We provide a lump sum maturity benefit equal to the Sum Assured plus any accumulated dividends less any outstanding policy loan if the Life Insured survives until Policy Maturity Date (age 100).

Participating – PRULove for Life is a participating policy. The Company will determine yearly the part of the divisible surplus of the Company that may be distributed to this Policy as dividend, if any. Dividends may be payable on this Policy every policy anniversary date but are not guaranteed.

Other Product Features

Optional Riders - Optional benefits can also be attached to PRULove for Life for a more comprehensive protection.

Total and Permanent Disability Plus (TPD+) Rider - Payable if the Life Insured becomes totally and permanently disabled due to bodily injury or disease for a continuous period of 6 months and it occurs before the policy anniversary immediately following the 65th birthday of the Life Insured and before the expiry date of this benefit.

Accidental Death and Disablement (ADD) Rider - Payable on top of the basic sum assured if the Life Insured dies due to accident within 180 days of the accident before the policy anniversary immediately following his 73rd birthday. In addition, this rider pays a specified percentage of the ADD benefit amount if the Life Insured sustains bodily injury in case of accident.

Life Care Plus (LC+) Rider – Payable on top of the basic sum assured if the Life Insured is diagnosed to be suffering from a critical illness or has undergone surgery before the policy anniversary immediately following his 65th birthday. This rider is yearly renewable with non-guaranteed premiums payable up to age 65.

Personal Accident (PA) Rider - Designed to indemnify the insured for injury or death due to accident before the policy anniversary immediately following his 73rd birthday. This rider consists of core and optional benefits.

Hospital Income (HI) Rider - A comprehensive hospitalization benefit that provides daily and lump sum cash benefits to Life Insured to cover the cost of hospitalization due to injury or illness until age 65. This rider is yearly renewable with non-guaranteed premiums payable up to age 65.

Waiver of Premium on Total and Permanent Disability (WPTPD) – Waives all future premiums for the basic plan, Accidental Death and Disablement (ADD) Rider, and Personal Accident (PA) Rider up to the end of the premium paying term, if the Life Insured becomes totally and permanently disabled due to bodily injury or disease before the policy anniversary immediately following his sixtieth (60th) birthday.

Life Care Waiver (LCW) - Waives all future premiums for the basic plan, Total and Permanent Disability Plus Rider, Accidental Death and Disablement (ADD) Rider, and Personal Accident (PA) Rider up to the end of the premium paying term, if Life Insured is diagnosed to be suffering from a critical illness or has undergone surgery before the policy anniversary immediately following his sixty fifth (65th) birthday.

Payor Waiver of Premium - Waives all future premiums for the basic plan, Total and Permanent Disability Plus Rider, Accidental Death and Disablement (ADD) Rider, and Personal Accident (PA) Rider up to the end of the premium paying term, upon the death or total and permanent disability of the payor before the policy anniversary immediately following the twenty-fifth (25th) birthday of Life Insured or the policy anniversary immediately following the sixty-fifth (65th) birthday of the payor.

Non-forfeiture Options – Option that the Policyowner selected during product application which s/he can apply when premium due is not paid within the grace period and the Policy has accumulated cash value to keep the policy in force. The following are the Non-Forfeiture options available for this plan: Extended Term Insurance, Net Surrender Value, Reduced Paid-up Insurance, or Automatic Premium Loan.

The full policy provisions of the features and benefits specified in this page shall apply. Should there be any inconsistency between the features and benefits stated herein and the Policy Contract, the latter shall prevail.